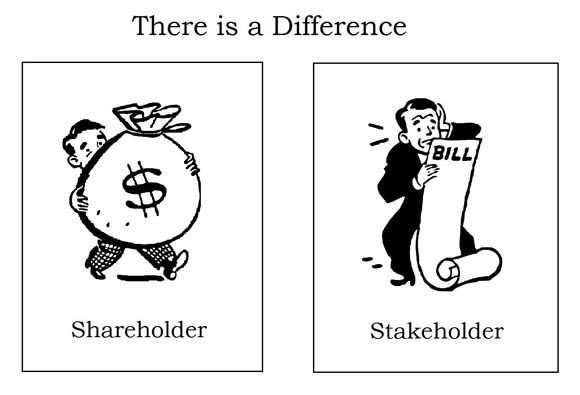

A single-minded focus on shareholder profits may not serve the interests of society, the company, or shareholders themselves. (graphic ©ratsinthebelfry.blogspot.com)

Shareholders vs. Stakeholders

Lynn Stout

Lynn Stout’s book, The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the Public was a subject this week in Jack Welch’s blog, Tom Peters’tweets and an article in the Harvard Law School Forum on Corporate Governance and Social Reform.”

“Shareholder-value thinking dominates the business world today. Professors, policymakers, and business leaders routinely chant the mantras that public companies ‘belong’ to their shareholders; that the proper goal of corporate governance is to maximize shareholder wealth; and that shareholder wealth is best measured by share price (meaning share price today, not share price next year or next decade).

This dogma drives directors and executives to run public firms with a relentless focus on raising stock price. In the quest to “unlock shareholder value” they:

• sell key assets

• fire loyal employees

• ruthlessly squeeze the workforce that remains

• cut back on product support, customer assistance, and research and development

• delay replacing outworn, outmoded, and unsafe equipment

• shower CEOs with stock options and expensive pay packages to “incentivize” them

• drain cash reserves to pay large dividends and repurchase company shares

• leveraging firms until they teeter on the brink of insolvency

• lobby regulators and Congress to change the law so they can chase short-term profits speculating in high-risk financial derivatives

Yet many individual directors and executives feel uneasy about such strategies, intuiting that a single-minded focus on share price may not serve the interests of society, the company, or shareholders themselves.

Family Business, smart family business, interested in the future and not consumption believe in stakeholders rather than shareholders.

Stakeholders believe in a greater good, the community. Stakeholders believe what’s good for the business is good for the community. Jobs and commerce are good for the community, “A rising tide lifts all boats.” In a 1963 speech John F. Kennedy used this phrase. The idea, similar to stakeholders and concerned Family Businesses is that we all have a stake in prosperity. “Shareholders-versus-stakeholders” and “shareholders-versus-society” debates are continuing in the blogosphere. Small Businesses, Family Businesses in for the long haul believe that business is about value. Value comes from providing quality, service and what customers need when they want it.

Stakeholders believe in a greater good, the community. Stakeholders believe what’s good for the business is good for the community. Jobs and commerce are good for the community, “A rising tide lifts all boats.” In a 1963 speech John F. Kennedy used this phrase. The idea, similar to stakeholders and concerned Family Businesses is that we all have a stake in prosperity. “Shareholders-versus-stakeholders” and “shareholders-versus-society” debates are continuing in the blogosphere. Small Businesses, Family Businesses in for the long haul believe that business is about value. Value comes from providing quality, service and what customers need when they want it.

One of Stout’s main points, “Shareholders are neither owners, nor principals, nor residual claimants. Directors have primacy.”

The “business judgment rule gives them tremendous latitude with regard to claims on the corporation, including decisions that reduce share price.” We would argue this is a linchpin in the difference between shareholders and stakeholders. Stakeholders have a direct involvement, in an organization and can affect its outcome.

Leave a Reply